[Photo credit: 401Kcalculator.org]

Disclaimer: The information provided in this blog post is for informational purposes only and is not intended to be legal advice. Please consult a tax professional for specific tax guidance.

In order to sell products within the State of Connecticut (i.e. an Etsy seller who lives in Connecticut running a home-based business), you must first have a Sales and Use Tax Permit. It's basically a blue piece of paper with your company's name, your name, your address and your tax I.D. number on it. The process of getting this permit is relatively painless: you just fill out this form online, by mail, or in person. It costs $100, but it's good for 5 years.

If all your sales are done online, you only need to file state sales taxes for items shipped to customers within the state of Connecticut. (So if for example you sold a lovely Schiaparelli turban hat to a customer in California, you should not pay sales tax to the state on it. Learn from my mistakes!) If you also sell your items at a physical location (brick and mortar store, craft fair, vintage market, "pop-up" shop, etc.) in Connecticut, you will also need to charge and file sales tax for those items as well. Oh, and if you didn't have any sales that quarter (yep, I've been there), you do still need to file - you just won't pay any taxes. (And if you think "Oh, little old me? They'll never come after me if I don't file!" - think again. I just got a letter for a quarter I forgot to file a year ago which included a penalty of around $100. Fortunately, since I didn't actually make anything that quarter, I went back and filed and the penalty was removed. But still.)

Sales and Use permits vary from state to state. It is my understanding that as an Etsy shop operating in Connecticut, you are responsible for Connecticut state sales taxes (in addition to your federal taxes of course) on items shipped to addresses in Connecticut only and not for any other state. However, if you are looking to vend at events such as craft fairs or flea markets outside of the state (as many Etsy sellers do), that state will require you to have a Sales and Use Tax permit for their state, and most likely the venue will need proof in order to register to sell there. Here are some links to Sales and Use Tax info for CT's neighboring states:

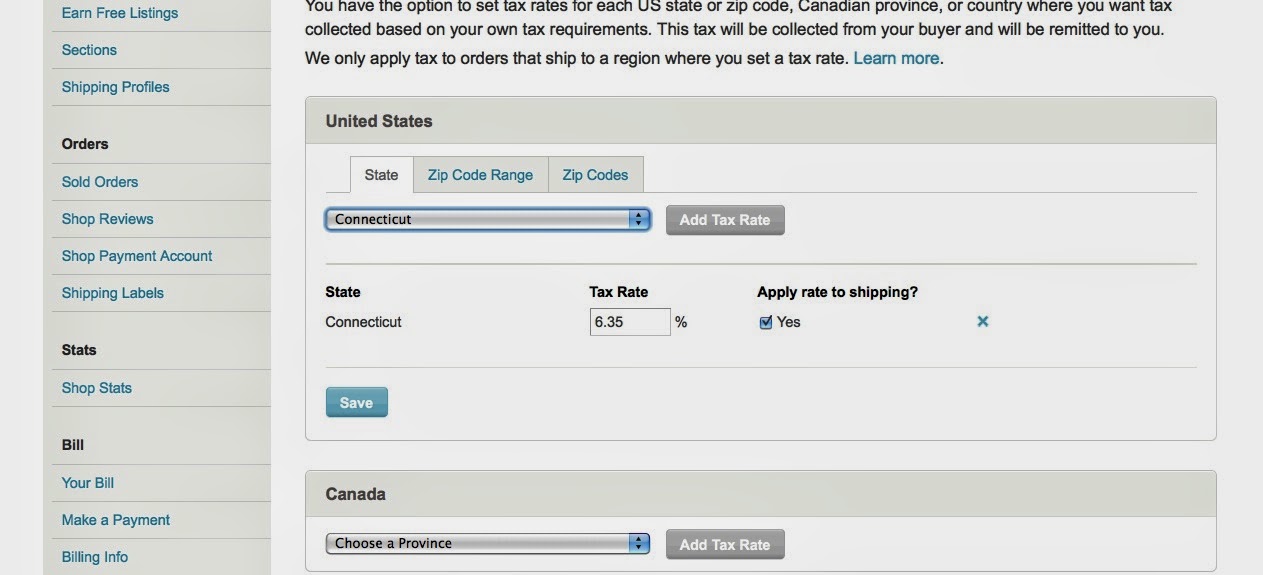

As far as charging sales tax to Connecticut residents, Etsy makes it easy. You can set up your Etsy shop to calculate the sales tax for Connecticut customers automatically. Under "Shop Settings" on the left-hand side, go to "Payment." Select the middle tab in the center of the page titled "Sales Tax":

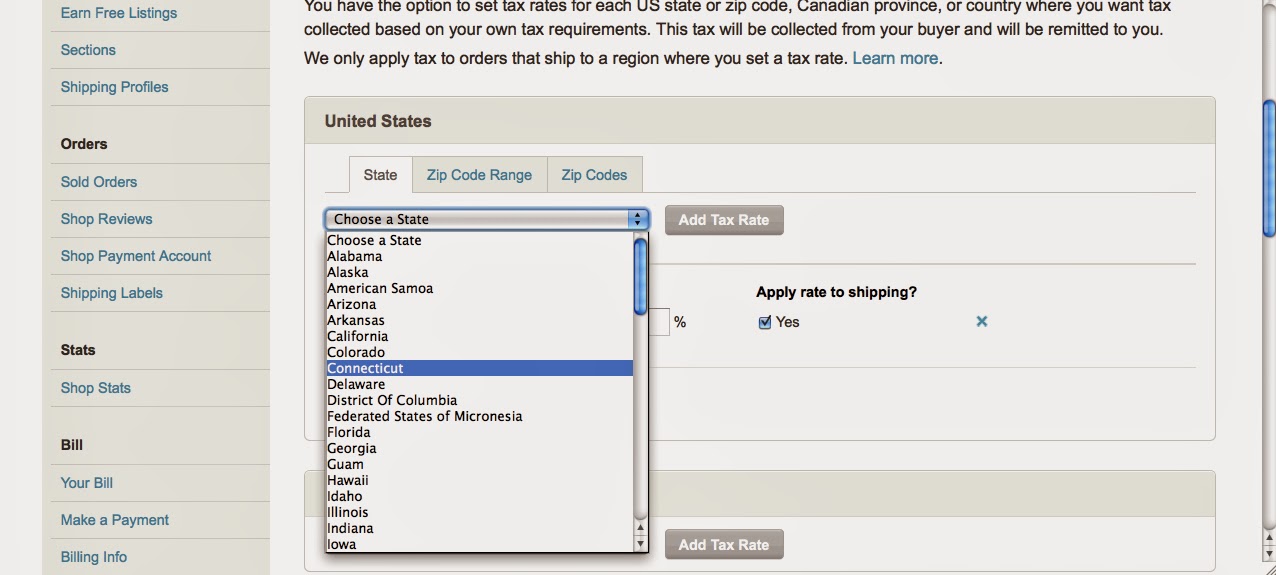

and choose Connecticut for your state from the drop-down list:

Next, enter in the sales tax percentage amount (for my vintage clothing shop, it is 6.35%, but you should double check the state's website for your situation), and select the box marked "Yes" to apply the rate to shipping. Hit "Save" and you're all set! Etsy also provides helpful information regarding applying sales tax here.

Once you have the permit from the state and your Connecticut tax calculator set up on Etsy, you'll have to file your sales taxes quarterly for everything sold to customers in Connecticut. The easiest way to file is online, and you are indeed required to file every quarter, regardless of whether you actually made any sales or not. The Connecticut tax return site will calculate how much you owe in sales tax and offers a few different payment options.

See how to apply Connecticut sales tax to your Etsy shop here.

fantastic summary.

ReplyDeleteThis is a perfect example to get ideas about tax calculation. Thanks for sharing such informative article.

ReplyDelete